December 2022 Quarter - Brisbane

- Posted By David Brown

The Australian housing market in 2022 was characterized by significant changes and challenges due to the ongoing COVID-19 pandemic and the resulting economic uncertainty. Despite the initial slowdown in the market during the early stages of the pandemic, the market saw a sharp rebound in demand and prices, fueled by record-low interest rates and government stimulus measures. This surge in demand, however, also led to concerns about housing affordability and potential housing bubbles in some regions. Additionally, changing demographics, such as an aging population and increasing demand for sustainable and affordable housing, have further contributed to the complex and dynamic nature of the market. As we look back on the year 2022, it is clear that the Australian housing market underwent significant transformations and adjustments in response to changing conditions, laying the groundwork for what promises to be an equally intriguing and challenging year in 2023.

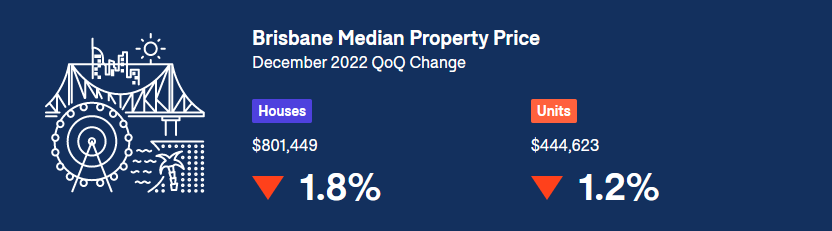

The decline in Brisbane's housing market showed signs of slowing down during the December quarter, as house prices fell at a slower rate than the previous quarter. However, despite the easing of the decline, house prices have still fallen for two consecutive quarters, resulting in the largest annual decline in ten years. House prices have now dropped by 6.6% from their peak in June 2022, equivalent to a decrease of approximately $56,000. Along with Sydney and Canberra, Brisbane has experienced the sharpest reduction in house prices from its peak, but they still remain significantly higher than pre-pandemic levels, with an increase of 34.4%.

Domain House Price Report - December 2022 | Domain

Domain House Price Report - December 2022 | Domain

Although unit prices experienced their most significant quarterly decline in nearly two years, the pace of the decrease was still less severe than that of houses. Additionally, unit prices have outperformed house prices for three consecutive quarters, which hasn't happened in over a decade. Unit prices have now fallen by 1.7% from their peak in June 2022, equivalent to a decrease of approximately $8000. Despite the fall in unit prices this quarter, they are still 2.9% higher than they were a year ago, although annual gains have slowed to a 15-month low.

As we move into 2023, the Australian housing market is expected to continue to evolve and transform in response to changing economic, demographic, and policy conditions. While there are some uncertainties and risks that may affect the market, such as rising interest rates, potential policy changes, and ongoing COVID-19 related disruptions, there are also several factors that could support continued growth and demand, including population growth, strong economic fundamentals, and a sustained demand for sustainable and affordable housing. Nevertheless, it is important to recognize that different regions and markets across Australia may experience varying levels of activity and trends, and potential buyers and sellers should carefully evaluate local market conditions before making any major investment decisions. Overall, 2023 promises to be another intriguing and challenging year for the Australian housing market, and those involved in the market should remain vigilant and adaptive to the changing landscape.

TOP STORIES