Herron Todd White Property Clock March 2024

- Posted By Chris Nicholson

Herron Todd White (HTW) is the leading property valuers in the country. Each month they release a monthly update and property clock. This gives a fair idea as to what to expect from the property market in the coming months.

When looking for a reliable insight into the property market, HTW gives an unbiased review of the current state of the market and what to expect in the coming months. After all they are the finance valuers that determine if people get finance or not.

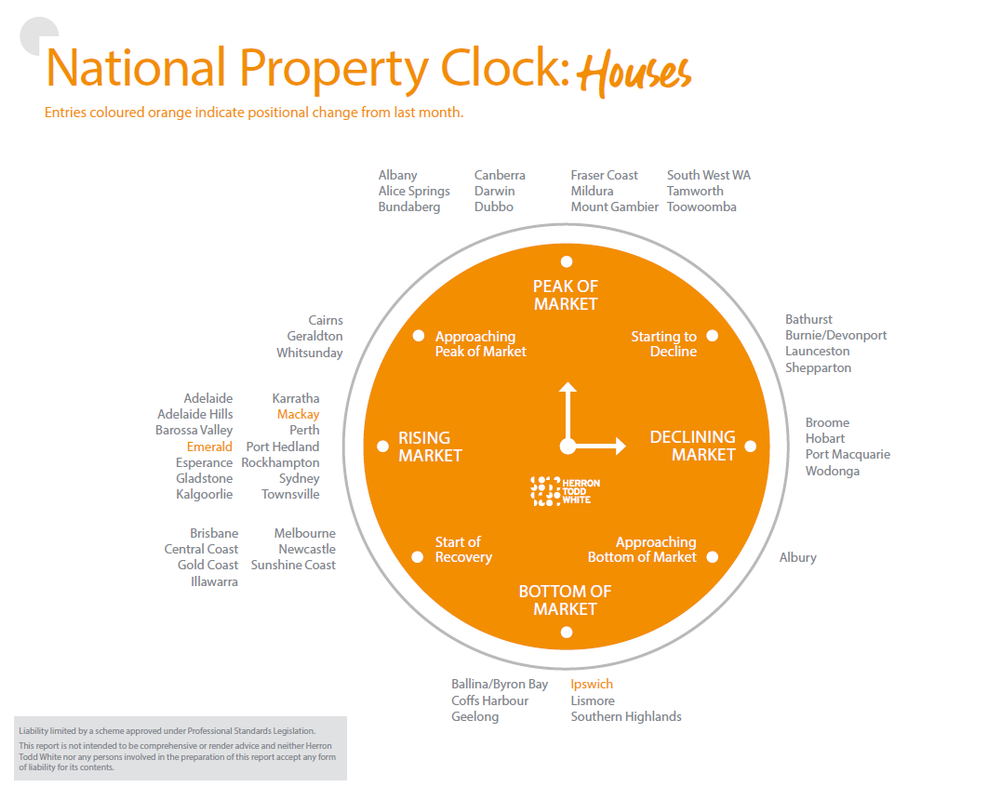

Here is the latest property clock and the Meridien view on what is happening in Australia’s property market. It has been long expected that some markets will decline but no one knew just how long this property boom would last, but as evident below it is clear that some markets are beginning to slow.

Victoria

The Victorian investor market has faced significant challenges over the past year, influenced by record migration and the introduction of a new flat rate tax of up to $975 for owners of second homes or investment properties. Starting January 1, 2024, an additional levy on the value of their land has also been imposed. This "temporary" measure, set to last for 10 years, aims to help the government reduce its COVID debt. According to The Age, the State Government estimates that 860,000 Victorians are affected by this new levy.

Combined with the record migration of 510,000 people to Australia, this COVID debt levy has led to significant rental increases across Melbourne. The median unit price in Melbourne has been relatively stagnant, rising only 1.76 percent to $633,000 over the year, partly due to 13 interest rate hikes and some investors selling off their properties.

On a positive note, the surge in migration has driven vacancy rates down to a record low of 1.1 percent in January 2024, as reported by SQM Research. This means investors have had little trouble finding renters, and rental prices have increased.

February ABS figures revealed an 18.4 percent drop in dwelling approvals for units in Victoria from the previous month, while house approvals saw a slight increase of 1.2 percent. This indicates a limited supply of new properties for investors, which could potentially lead to rising prices in the future.

Queensland

Brisbane offers promising opportunities for property investors in 2024, underpinned by strong fundamentals. The city's real estate remains relatively affordable compared to Sydney and Melbourne, making it an attractive entry point for new investors.

Rental demand is exceptionally high, with vacancy rates hovering around one percent, indicating that rents are likely to continue rising. Long-term drivers such as the upcoming 2032 Olympic Games and associated infrastructure projects also bolster the city's appeal.

While the overall outlook is positive, property markets are nuanced, requiring a closer look at specific locations.

Western Australia

The Western Australian residential property market has shown remarkable resilience over the past couple of years. Unlike other markets that struggled with rising interest rates, Western Australia's lower entry costs attracted investors. Active listings remain near record lows, with 3,738 listings at the end of January 2024, a 46.2 percent drop from the previous year. Houses sold in a median of nine days, one day faster than December and 15 days faster than a year ago. Demand for units has also increased, with the median time on the market dropping from 43 days to 13 days year-over-year.

The median house price in Perth rose to $600,000 in January, up 1.7 percent from December and 9.9 percent from January 2023. The median unit price saw a modest 0.5 percent increase from December to $410,000, with a year-over-year growth of 2.2 percent. Despite this, valuers report significant activity and upward pressure on unit prices.

Vacancy rates across Western Australia remain extremely low, at just 0.7 percent in January 2024 for the metro region, empowering landlords to raise rental prices. Regions like Albany, Bunbury, and Geraldton also have vacancy rates at or below one percent.

Eastern states buyers are active, especially in Perth's outer suburbs where rental yields are high. Suburbs such as Medina, Brookdale, Langford, and Armadale exhibit yields from 6.0% to 6.4% at a median price around $400,000. For units, Orelia, Bayswater, and Glendalough have yields ranging from 7.4% to 9.0%.

Western Australia's relative affordability compared to eastern states, along with strong net migration, underpins rental demand. Over 73,000 people migrated to WA in the year to June 2023, requiring an additional 30,000 homes, yet only about 14,000 new homes are built annually, creating a substantial shortfall.

In January, Perth's median weekly rent for houses rose to $640, a 3.2 percent increase from the previous month and a 16.4 percent jump from January 2023. Median unit rent also grew, rising by 1.8 percent over the month and 20.8 percent over the year to $580 per week.