Review March 2021

- Posted By David Brown

It’s been twelve months since Australia implemented measures to suppress and control COVID19. During that time, we’ve discovered ways to adapt, endure, and even thrive, in our endeavours. The real estate industry came out with a lot of innovation such as virtual inspections, online auctions and zoom presentations. It was expected to residential real estate sales and rentals to struggle, but nowadays we are seeing extraordinary demand from buyers and tenants.

The market turnaround was led in large part by first homebuyers looking to take advantage of government assistance but also other buyer demographics such as ex-pats and upgraders. The end result has been an increase in property values and, rising rents as well.

Investors remained fairly quiet last year as we all hunkered down and waited for events to unfold.

Heading into 2021, there’s been a change in the air as property investors start to get very active in centres across the nation.

It's clearly a good time to be getting into the market.

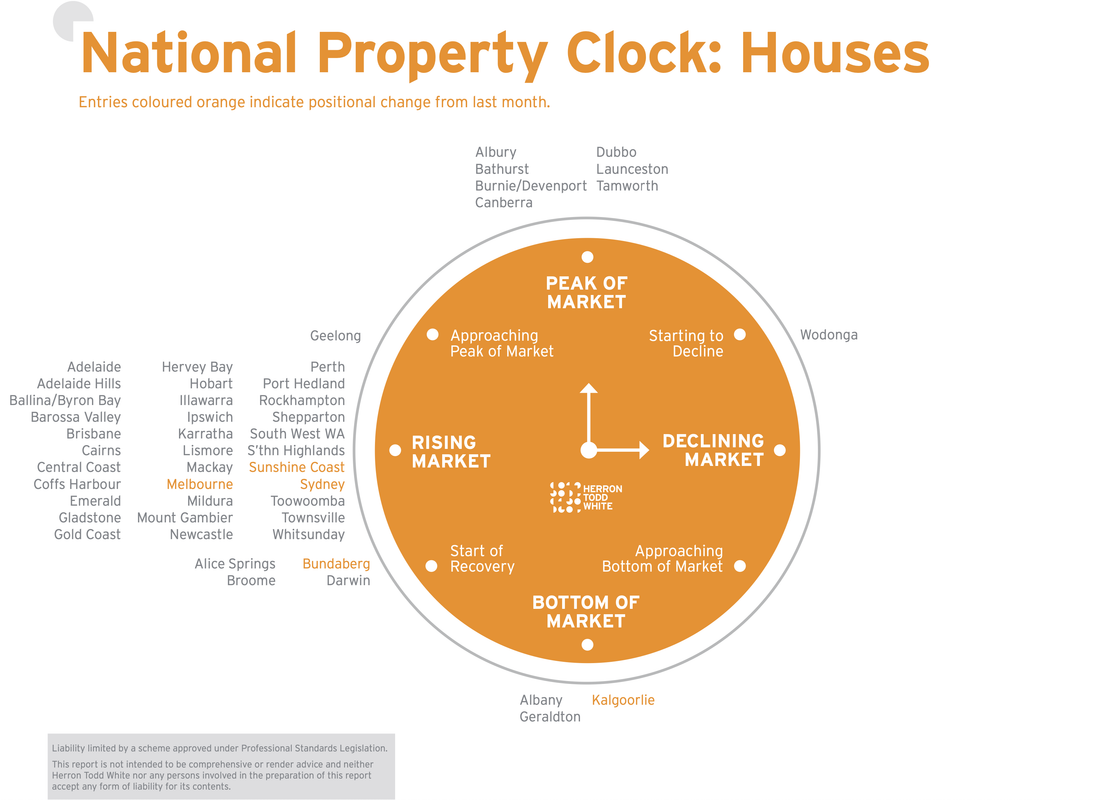

We have never seen so many markets in the positive phase of the cycle - from Adelaide to Whitsunday, it's a very positive outlook.

The whole of South East Queensland is on the upward move with increased demand driven by expats returning and a big increase in net interstate migration. Combine the increased demand with less supply of new homes, land and a drop in resale listings, and price growth is certainly something investors can look forward to.

Sydney

Investors took a back seat, particularly to first home buyers, in the Sydney property market during 2020, as rental returns eased and vacancy levels increased across many suburbs. Across Sydney, residential vacancy rates hit a high of four per cent in May 2020, up significantly from the pre-Covid level of 2.9 per cent in February. This has since recovered, and sat at 3.2 per

cent in January 2021, despite the impact of no immigration or international students over the past 12 months. Although improving, this vacancy rate still sits significantly above the 1.5 to two per cent range that Sydney experienced through most of 2010 to 2018.

Rental returns have also been decreasing since 2012 as rental prices have failed to keep pace with sale prices since that time. In February 2020, gross rental yields for units in Sydney were 3.7 per cent and 2.7 per cent for houses. By January 2021, these had eased to 3.5 per cent for units and 2.3 per cent for houses. This would suggest that units still provide the best income return for investors, however, houses have outperformed units in capital growth over the past 12 months and this is expected to continue in the next 12 to 24 months.

Rental returns have also been decreasing since 2012 as rental prices have failed to keep pace with sale prices since that time. In February 2020, gross rental yields for units in Sydney were 3.7 per cent and 2.7 per cent for houses. By January 2021, these had eased to 3.5 per cent for units and 2.3 per cent for houses. This would suggest that units still provide the best income return for investors, however, houses have outperformed units in capital growth over the past 12 months and this is expected to continue in the next 12 to 24 months.

With interest rates at record lows and likely to be so for a few years to come, strengthening property values and improving vacancy rates, more investors are likely to be enticed back into the market in 2021.

Meridien Insight

With prices ever-increasing in Sydney affordability is becoming more and more acute for owner-occupiers. Rental yields for investors are lower than what can be achieved in SE Queensland. More Sydney people are looking to the North (SEQ) as an affordable and lifestyle alternative to the outer edges of Sydney. Investors seeking yield rather than just growth would be well-advised to look to the North also where yields are around double that of the Sydney mean returns.

Sydney - South-West

Over the past six to 12 months, investor activity in south-western Sydney, on the whole, has remained steady. Whilst there has been a real shift with first homeowners driving this space, the continued affordability of brand new or modern low maintenance products in the sub-$750,000 range, strong rental demand, steady returns of between three and four per cent and low-interest rates has ensured the continued presence of investors in today’s south-west market.

Moving forward we see investment really focusing around key future infrastructure such as the Western Sydney Aerotropolis and around the greenfield suburbs such as Oran Park, Leppington and Edmondson Park which are already benefiting from existing infrastructure and growing communities.

The traditional investor grade stock generally focuses on entry-level affordable project homes within new estates which feature basic fit-out and low maintenance running costs, or units located in close proximity of local services with low strata levies.

We see a more expansive buyer pool of investors moving away from what has traditionally

been a local investor market. Price points, low interest rates and the growing appeal of new infrastructure have seen investors from across greater Sydney diversify into the south-western markets.

The market for units in Sydney’s southwest has traditionally been centred around the local CBDs of Liverpool and Campbelltown. During the past 12 months, oversupply and lack of new infrastructure have really pushed both prices and rentals down in this asset class. Moving forward we see greater opportunities in the emergence of modern units in typical house orientated greenfield developments such as Oran Park and Ed Square which will cater for the growing demand of community living within existing communities.

Sydney - North-West

With the current cash rate at record lows, many investors are turning to residential property

for greater investment returns. And for good reason. The wider Sydney property market has been quite resilient during this global pandemic and for many local investors, the security of bricks and mortar as an investment is a familiar, and often the first, go-to strategy.

Within western Sydney we have seen a number of different asset types being traded highlighting that whilst first home buyers might be fuelling the entry point of the market, investors have not completely gone away.

Western Sydney has always been a smart choice for investors and owner-occupiers alike and this should continue throughout 2021. The high level of infrastructure investment in the region coupled with relatively lower median house prices and the shift to more people working from home have highlighted that more affordable and larger homes with backyards are hot property now.

As a pure investment property, duplex pair sales are few and far between but when they transact they seem to achieve a strong result. A recent sale in Toongabbie of a duplex pair achieved $1.81 million in January 2021. This was a new property offering two five-bedroom, three-bathroom, one-car garage attached dwellings on 600 square metres of land in total. With a potential rental of $750 per week each, this equates to a 4.30 per cent gross yield.

Another example is Rooty Hill sold in January 2021 for $950,000. This was a single level circa 2000s duplex pair offering three bedrooms, one bathroom and one-car garage each. With an estimated rental of $450 per week each, this equates to a gross yield of 4.92 per cent.

A popular addition to many backyards across western Sydney is the humble granny flat.

A recent example was a sale in Merrylands for $1 million. This property offered the main dwelling with three bedrooms and one bathroom and a granny flat providing four bedrooms and two bathrooms - a larger than usual flat as most are two-bedroom. The total rental return is $990 per week which equates to a gross yield of 5.14 per cent.

Furthermore, with the rise in working from home arrangements, prospective tenants will likely be after more space, whether that is a home office (study or second bedroom) or a courtyard (for the lockdown Labrador). It is therefore likely that we will see higher vacancy rates in the smaller apartments and boarding or share houses which are common around inner-city Sydney.

Tweed Shire

The Tweed Shire has been undergoing major changes in the investor market since the onset of COVID-19. Why? The regional boom! Need we say more? Across the Tweed, vacancy rates have been low for years and have been exacerbated further since the onset of COVID-19.

Initially, when COVID-19 hit, there were investors who sold up fearing the worst, however, this quickly turned around with agents across the Tweed Shire reporting that their main investor clientele is coming from Sydney, Melbourne and Brisbane areas.

Interestingly, the major investor profile now is city folk who intend to rent their new purchase for six months to two years before they move into the property themselves.

Rents have also seen a hike with more demand from city dwellers who want out of the cities and want to try before they buy. Property managers are receiving offers above the asking rent price, in some cases $100 per week more or 12 months advance payment.

Despite this, the region is now predominantly attracting owner-occupiers with fewer long-term investors purchasing than pre-COVID-19. Even with rental prices having a hike, the yields are low with many properties being negatively geared. Current yields are roughly around three to five per cent gross, with Banora Point presenting the highest yields and the popular coastal towns the lowest yields.

The most affordable and popular areas in the Tweed Shire for investors are around Tweed Heads, Banora Point, Terranora and Bilambil Heights, however higher capital gain opportunities can be found in the coastal towns of Kingscliff, Bogangar and Pottsville. The most popular investments in all areas are detached dwellings with duplexes and townhouse-style units also being popular over the past few months.

The main problem for investors across the shire at the moment is low stock levels with open houses having large numbers through and multiple offers within the first week of the property being listed. Therefore, most investors will find themselves having to pay top dollar to secure a property.

Gold Coast - Southern

The housing market particularly between Mermaid Beach and Tugun has been a shining light over the past two to three years and this has never been more evident than what we witnessed in the last quarter of 2020 and the first six weeks of 2021, with record prices being achieved. In some suburbs, it has been reported that value levels have increased by ten per cent or more since Christmas! The strong surge in property prices has made it difficult for short term investors seeking affordable property in this area with a good return on investment, with very limited levels of stock available. Strong increases in rental prices since late 2020 have also added more fuel to the residential market in this part of the coast.

Most agents are reporting that investors are more active now in the southern Gold Coast than say six to 12 months ago. We are hearing of increased domestic migration to the Gold Coast and Tweed Shire post the height of the COVID-19 pandemic and this has been arguably one of the main reasons why the property market has been so buoyant of late. Based on the latest feedback from local agents, industry experts and economic indicators, it seems that the strong market conditions will remain throughout 2021.

The strongest areas for both investors and owner-occupiers are still closest to the beach and the strongest type of property for capital gains are still detached dwellings, duplex units and townhouse or villa units in small complexes, with lower body corporate fees. However, given the spike in property values this year, yields are generally only in the two to four per cent gross range.

Gold Coast - Central

Investor activity for high-rise apartments in the hub of Surfers Paradise throughout 2020 was largely diminished as a result of the COVID-19 pandemic. Traditionally this locality has been driven by investors chasing higher returns from short term or holiday letting either through on-site management or via other means such as Airbnb. Since the height of the pandemic, these returns have been significantly reduced and the months that followed saw an exodus from the short-term letting market and a shift to a more traditional rental arrangement of six or 12-month permanent rental leases.

In some cases, on-site managers were happy not to renew letting agreements with unit owners as they couldn’t fill the room nights required to make it viable.

Local agents are starting to see more interest now in 2021 for highrise units and this can be once again attributed to the recent influx of demand from southern investors, mainly from Sydney and Melbourne. We have been informed that many of these investors are looking to buy with a view to holding it as a lock-up or future holiday home and are not so concerned with the holiday rental return. The motivation here is to have a bolt hole to run to if their suburb or city goes into lockdown.

It is likely that investors will eventually return to short term or holiday letting their units once COVID-19 issues are close to being nullified. Investors looking to purchase units in Surfers Paradise are generally chasing a four per cent yield as reported recently by some real estate agents and if the projected return falls close to the three per cent level, investor interest really drops off.

We have noticed that despite the increased market activity within the area, one-bedroom units with less than 50 square metres of living area on Chevron Island in Surfer Paradise are still taking some time to sell due to financing lending limitations by the banks. Price levels have remained stable over the past three years, bubbling along in the $195,000 to $225,000 range. Rental levels are in the $300 to $325 per week range.

Gold Coast - Northern Corridor

Historically, there is a large presence of investment properties in this region, especially in the older parts of Coomera and a large portion of Pimpama and some of Ormeau. Eagleby has always had a high proportion of investor housing, which is targeted towards the lower-income group.

Medium-density housing in the form of townhouses and duplexes is the dominant type for the investor market and the majority of investors are from Sydney or Melbourne. Small lot houses also get snapped up by investors. Amongst the investment estates are various estates and areas known to be dominated by local buyers who are mainly owner-occupiers. These include Coomera Waters, Gainsborough Estate and Jacob Ridge Estate.

When COVID-19 emerged in 2020 and interstate travel became more and more restricted, the market scenario began to change from an investor dominant market to a local buyer dominant market. As a result of a significant fall in the number of investors coming from the south, townhouse developments suffered a huge drop in demand whilst demand for detached houses rose quickly as a result of rising demand from local buyers, especially first homeowners who began to devour the small lot houses priced between $400,000 and $500,000. Sales of townhouses in the high $300,000s stalled due to lack of demand from southern investors.

Then came the government grants which ignited a huge demand from locals and many sold their homes to build new ones. This led to upward pressure on rents as ex-owner-occupiers became renters, further competing with the long-term renters. Developers and builders also took advantage by raising prices, resulting in small lot housing being priced above affordability levels of first home buyers.

This led to an increased demand for townhouses from local buyers, hence filling the gap left by the southern investors. Consequently, developers continued to build new townhouses and sold this product for around $400,000 to $450,000.

Whilst there is a spike in the price of vacant land due to fast diminishing stock for sale, the increase in existing detached house prices has not been that great and hence the premium between old and new has widened. There is a growing fear amongst local buyers that the government grants will end and investors from the south will return in droves when restrictions are lifted, resulting in less opportunity to find their long-term homes. Hence, there is another spike in the rising demand line.

For those looking to invest in the northern corridor at this time, we have seen a rising trend of investors going for affordable townhouses and duplexes. In Eagleby, rising rents are providing positive returns due to house and unit prices remaining relatively stable, however, the properties here are mostly old and investors must be prepared for some unexpected capital expenditures.

There also appears to be a growing trend for investing in new duplex pairs as the returns are high (six to seven per cent gross return) and rents of $600 to $800 per week are being commonly achieved. However, the supply of duplex pairs is currently scarce and designated lots to build duplex pairs are also hard to come by at present, particularly in estates where developers are targeting owner-occupiers.

Sunshine Coast

It is fair to say that the 2021 Sunshine Coast property market is off and running. Typically, the start of the year can be a little patchy. People are still on holidays, parents think about getting their kids ready for school and basically, everyone tries to get themselves motivated for the year ahead. Not this year.

The first two months have continued on from where 2020 left off. Stock levels remain very low and demand is strong. The market is extremely dynamic with upward pressure on values so we are seeing new value benchmarks being set. At first, this trend started in the northern Sunshine Coast region around Noosa Heads. This has now stretched right across the Sunshine Coast and in most asset classes.

We all have a fair indication of the main drivers of the market which we have discussed in previous Month in Review editions, but what is becoming apparent is that when we look at the level of competition, there are some external value relativities influencing decisions. Purchasers coming from an external market (say Sydney or Melbourne) will look at a property and all its attributes and think it’s pretty cheap compared to where they come from. That combined with that real fear of missing out is becoming more and more evident.

A recent case in point is a sale at Buddina that is under contract for $980,000 to an interstate purchaser. The property is an original circa 30-year-old home on a 578 square metre allotment. This shows a significant increase compared to a sale in September 2020 of a similar property 50 metres away which sold for $730,000.

When we look at the investment market, it is becoming a little hard to decipher. There are investors active but when you get down to the detail, a fair portion is purchasing with a view to moving to the area and into the property at a later date, so when we take that into account, there is little doubt that the true investor market has softened over recent times given the level of completion.

The main driver for investors appears to be yield. This is being ably assisted by the current rental market which is one of the strongest in Queensland with vacancy rates below one per cent and rental values on the increase. When you are not getting any money in the bank, the security of bricks and mortar, getting a rental return and, if the market keeps going, an increase in your property value are all pretty appealing. Yields for a standard house in a modern estate work out to be circa 5.5 per cent, so not a bad investment.

For the unit market, it has been pretty hard. As always, the impact of body corporate fees has an impact on rental returns. Smaller complexes with lower body corporate fees have been the best performing.

Multi-tenanted properties or flats would provide a larger yield given their nature, but we acknowledge that they are pretty hard to find. The yield achieved by these property types is reflective of the income, age, number of flats and location.

Properties underpinned by development potential or situated in unique and sought-after locations tend to be at the lower end of the yield range. A yield at the higher end indicates there would be limited development potential with the current use being the highest and best.

Brisbane

According to a variety of reported opinions, it’s Brisbane’s time to shine.

The city has seen a stop-start-stagnate property market for close to a decade, with myriad factors (floods, unit oversupply, high unemployment, global pandemic) keeping our values within single-digit- per-annum growth across many suburbs. But 2021 feels like a whole new event. During the stop-start 2020 lockdowns in other states, Queensland managed to remain fairly much open to locals. It’s instilled a sense among our population that there’s no place on the planet you’d rather be than the Sunshine State, and as its capital city, Brisbane is reaping plenty of goodwill rewards.

In addition, we have continued on an infrastructure program that’s driving employment in the construction industry – not that the explosion in house building off the back of government pandemic stimulus wasn’t already creating plenty of activity.

And now it looks like we’ll be lighting the Olympic flame in 2032. Combine our local good news with a national vaccine rollout and historically low interest rates and it’s obvious why everyone in the Brisbane property game is walking with a little more spring in their step at present.

This month, we’ve been asked to talk about investor activity, and the subject couldn’t be timelier. This is because over the final months of 2020, as the market began to pick up momentum, investors didn’t seem to be part of the equation. Most of the focus was the rise in first homeowner activity, particularly in new construction. The result was blocks of land being snapped up faster than they could be released and long delays in securing a builder.

Property investors stayed on the sidelines. In terms of confirmed sales and qualitative evidence, investors remained relatively inactive in Brisbane and its surroundings.

But there are some very real signs that this is about to turn around. The first rumblings of investor activity are being felt and some data shows why investors are getting interested in Brisbane.

- CoreLogic analysis to 28 February reveals that Brisbane’s median home value rose 2.4 per cent across the year to date. A very healthy outcome that is priming the pump for growth.

- In the past three months alone, the change in dwelling values improved by 3.5 per cent according to CoreLogic. That’s a quick acceleration.

- Brisbane’s vacancy rate sits at 1.7 per cent, indicating a market where rental demand is outstripping supply. This fall is in line with anecdotal reports from property managers who are, in general, finding that appropriately priced, decent quality rental property is receiving plenty of tenant interest.

- SQM Research said asking rents for houses in Brisbane have hit $478 per week which is an increase on the year-low figure of $457 per week back in May 2020.

- The analysts at SQM also said Brisbane’s gross yield continued to hover around a very respectable 4.1 per cent.

Why is all this important? Because these are solid results that are catching the eyes of investors – particularly from other states. In short, our property remains relatively affordable, with strong price growth fundamentals and solid rental yields in a market where job prospects and net internal migration numbers are on the rise.

All this adds up to opportunity for investors – we just need to see more sales filtering through the system to confirm that the trend is well and truly entrenched.

In terms of detached dwellings, you’d be looking at basic three-bedroom cottages on standard blocks in close proximity to service and facilities, and within a reasonable commute of the CBD. This is good fundamental real estate that should see plenty of renter demand and solid value growth prospects over the medium to long term.

Our recommendation for investors would be to look for a detached home that’s at least 12-months old. You’ve lost some depreciation benefits – granted – but you avoid paying that new home premium on the buy in.

For attached housing, units remain a viable option for cash flow, but stock designed specifically for investors wouldn’t be our pick. While much of the inner-city oversupply of one-bedroom units have been absorbed, there is still some way to go before the market fully turns around and presents a buying opportunity.

Finally, some of the more unusual investment types including duplexes, flats buildings and boarding houses continue to see good interest in southeast Queensland. They provide solid income and can be an effective way to the land bank if they’re on larger sites in good suburbs, but listings are rare so competition (and prices) can be hot for some multi- income stream assets.

Meridien Insight

We are seeing the impact of the demand increase on a day-to-day basis. And, so are our builder partners. Every day there is a mad scramble to find good land to fulfil our investment client orders. When we do manage to find something good we have to hold onto to with one hand and get the client to sign the EOI with the other hand or it is another miss. It is just crazy and there is no ease up in sight as the supply pipeline of new land releases is probably 2 years shy of meeting the unplanned increase in demand.

Combine the land shortfall with the increased population growth rate and a mix change from higher and medium-density living to 'more space for us please' and the freestanding housing market now has some serious foundations for sustained growth.

Meridien Invest has a number of high yield projects in SEQ that will deliver clients the financial advantages of high cashflow combined with the market driving up values. It certainly is a good time to be investing in SEQ property.

Source: Herron Todd White